The National Pension Service (NPS) of South Korea purchased nearly $34 million in MicroStrategy (MSTR) shares during the second quarter of 2024.

With significant investments in other crypto companies, NPS – which happens to be the world’s third-largest pension fund by assets – has demonstrated a clear expansion of its interest in the digital assets space.

According to the latest filing with the US Securities and Exchange Commission (SEC), the fund acquired 24,500 shares at an average price of $1,377.48 each on August 13.

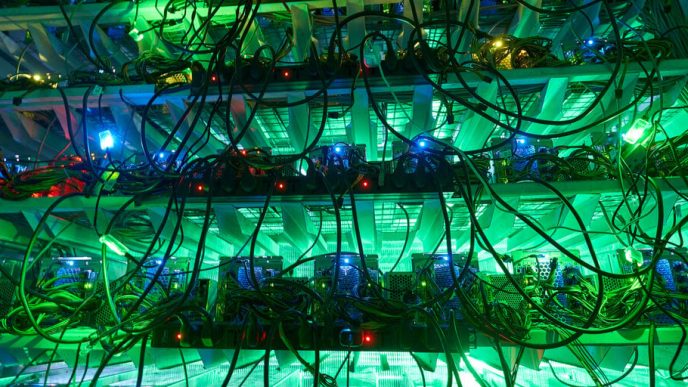

NPS’s investment is perceived as an indirect exposure to Bitcoin since MicroStrategy’s pivot to the industry. Initially famous for its business analytics software, MicroStrategy has transitioned into a significant entity in Bitcoin investments. This shift, largely attributed to CEO Michael Saylor’s strong advocacy for Bitcoin, has led the company to become the largest corporate Bitcoin holder under his leadership.

In 2024, MicroStrategy’s stock surged by 92.5%, surpassing $150 for the first time in more than 24 years, as per data compiled by Google Finance. Since August 2020, MicroStrategy has been acquiring Bitcoin, and its August earnings report indicates a further purchase of 12,222 Bitcoin for $805 million in the second quarter.

The filing also revealed that the fund – which boasts over $800 billion in assets – also holds 229,807 shares of Coinbase worth over $51 million. Additionally, it holds $31.5 million in Roblox and $61.5 million in Jack Dorsey’s Block.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Source link

Chayanika Deka

https://cryptopotato.com/worlds-third-largest-pension-fund-nps-acquires-34m-of-microstrategy-shares/

2024-08-16 10:42:38