XRP saw a 9% decline over the past 24 hours, mirroring the broader market downtrend. This general decline comes as the market gives a muted reaction to Donald Trump’s newly created Strategic Bitcoin Reserve and the just-concluded White House Crypto Summit.

With XRP’s bullish bias falling and market volatility increasing, the token may experience more price falls in the near term.

XRP Traders Exit Positions as Open Interest and Price Decline

As XRP’s price records a dip in the past 24 hours, its open interest among its futures traders has also plunged. This is at $3.39 billion at press time, noting a 3% drop during the same period.

Open interest measures the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When an asset’s open interest falls alongside its price, it indicates a decline in market participation.

This trend signals that XRP traders are closing positions without opening new ones, indicating weakening market momentum and uncertainty in its price direction.

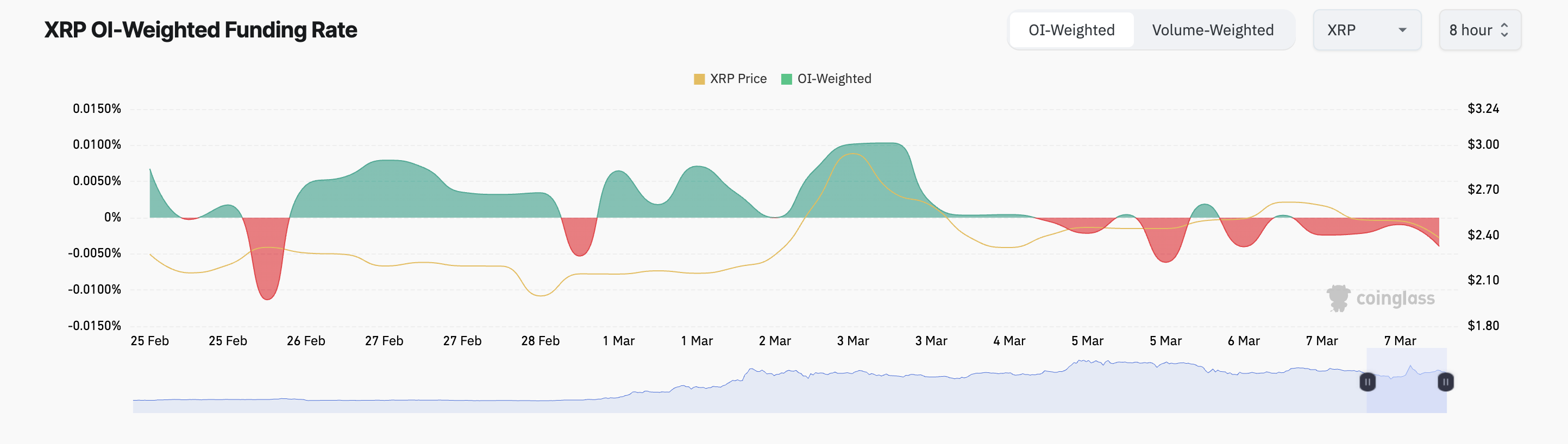

Additionally, XRP’s funding rate has been consistently negative in the past two days. This signals a heightened demand for short positions and reinforces bearish sentiment. At the time of writing, this is at -0.0040%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot price. As with XRP, when the funding rate is negative, short traders pay long traders. This indicates a higher demand for short positions, signaling a bearish market sentiment.

XRP’s Selling Pressure Intensifies—Will Bulls Step In to Defend Support?

On the daily chart, XRP’s negative Balance of Power (BoP) reflects the altcoin’s low demand. As of this writing, this indicator is in a downward trend at -0.38.

An asset’s BoP measures the strength of buying versus selling pressure by analyzing price movements over a given period. When its value is negative, it indicates that sellers are in control.

If XRP demand weakens further, its price could break below the support floor of $2.13, triggering a drop toward $1.47.

However, if the market trend shifts bullish and XRP traders begin to accumulate more, its price could rally past the resistance at $2.93 in an attempt to reclaim its all-time high of $3.40, which was last reached on January 16.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-bears-trigger-market-decline/

2025-03-08 11:30:25