XRP has fallen below the $2 mark for the first time since early February, following the broader market breakdown that has pushed most cryptocurrencies lower. Despite the intense selling pressure, XRP has held up stronger than many other altcoins, avoiding the steep declines seen across the market. However, uncertainty remains high, with analysts divided on XRP’s next move.

Related Reading

Some experts believe that if XRP can reclaim key resistance levels, it could trigger a recovery rally, bringing back bullish momentum. On the other hand, bearish analysts warn of further downside, arguing that XRP’s failure to hold above support levels could lead to a deeper correction.

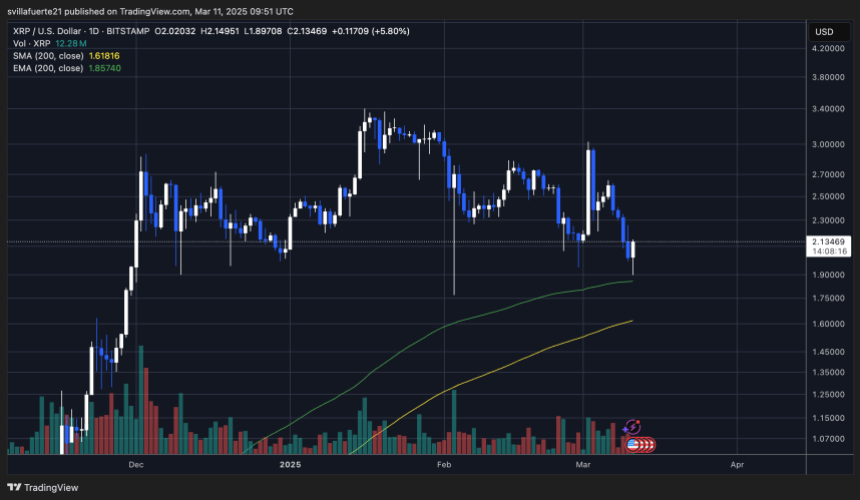

Top analyst BigCheds shared a technical analysis on X, suggesting that XRP is on the verge of breaking down below the $1.90 mark. If this happens, XRP could see increased selling pressure, leading to a larger drop in price. With price at a pivotal level, traders are watching whether it can stabilize and recover or if further losses are on the horizon. The coming days will be crucial in determining XRP’s short-term trend as market volatility remains high.

Crypto and Stock Markets Struggle Amid Uncertainty

The entire crypto market has been struggling as negative macroeconomic conditions continue to weigh on investor sentiment. U.S. President Trump’s policies and global trade war tensions have created an environment of volatility and uncertainty, making it difficult for markets to stabilize. As a result, the U.S. stock market has plunged to its lowest levels since September 2024, adding to the overall risk-off sentiment across all asset classes, including cryptocurrencies.

Related Reading

With fear and uncertainty rising, analysts are calling for a continuation of the downtrend across both traditional markets and digital assets. Investors remain hesitant to enter long positions, and many are waiting for clearer signals before making any moves. XRP, despite holding up better than some altcoins, is not immune to the broader market turmoil.

BigChed’s technical insights on X warn that XRP is flirting with a range breakdown on the daily chart. According to his analysis, if XRP loses the $2–$1.90 support level, it could trigger a significant drop, opening the door for further downside pressure.

As XRP hovers near this critical level, traders are closely monitoring whether bulls can defend key support or if the market-wide downturn will push prices even lower. With macroeconomic concerns and heightened volatility dominating the landscape, the coming days will be pivotal in determining XRP’s short-term trajectory.

XRP Holds $2 Amid Heavy Selling Pressure

XRP is currently trading at $2.13 after experiencing massive selling pressure over the past few days. Earlier, the price briefly dropped to $1.89, testing a critical support level before bouncing back above the $2 mark. Despite the short-term recovery, XRP remains under bearish control, and bulls must hold firm above $2 to prevent further downside.

For XRP to regain momentum, buyers need to push prices toward key resistance zones around $2.30–$2.50. A strong move above these levels could confirm a recovery, helping XRP avoid a larger market-wide sell-off. However, failing to defend the $2 support would put XRP at risk of a deeper correction, with the next major demand zone sitting around $1.60.

Related Reading

With volatility increasing across crypto markets, XRP’s price action remains uncertain. Bulls must step in soon to reclaim higher levels, or the risk of further losses will continue to grow. The next few trading sessions will be crucial in determining whether XRP can stabilize or if it will extend its decline toward lower price levels.

Featured image from Dall-E, chart from TradingView

Source link

Sebastian Villafuerte

https://www.newsbtc.com/news/ripple/xrp-flirts-with-a-daily-range-breakdown-price-must-hold-above-2-level/

2025-03-11 14:00:23