XRP traders are still regarding an ETF approval as inevitable, analysts noted, as the token has jumped 7% over the last 24 hours and nearly 23% in the past seven days, according to CoinMarketCap data.

The coin has been trading with a clear uptrend ever since Republican candidate Donald Trump won the United States presidential election.

One thing that has been holding the XRP price back for years is its ongoing legal dispute between its creator, Ripple, and the United States Securities and Exchange Commission (SEC).

Ripple proponents rejoiced when a judge issued a summary judgment concluding that the company’s sales of XRP to retail investors on digital asset platforms did not violate U.S. securities laws. Still, this was soon favored by the regulator filing an appeal.

Pav Hundal, lead analyst at Australian crypto exchange Swyftx, told Decrypt that “the market is putting all its chips on the table for an XRP ETF approval and a less hostile SEC.”

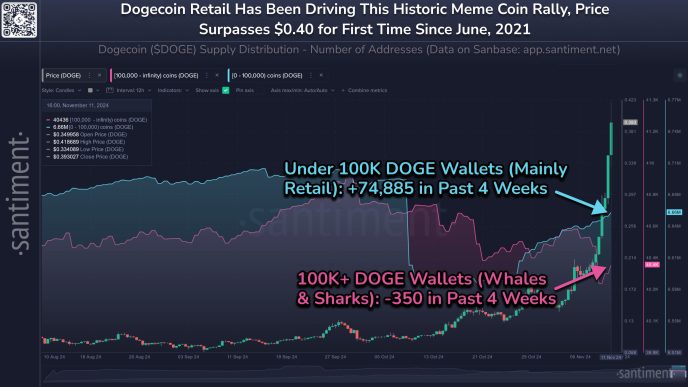

He added that the exchange’s personnel noticed trades rotating from Solana (SOL), Ethereum (ETH) and Dogecoin (DOGE) to XRP.

“Global spot volumes on XRP at thirteen times the levels they were a week ago. It’s economics 101. At this stage we’ve seen sellers absent, and demand soar,” he added. Hundal concluded that “these next few days will test the conviction of investors.”

Ryan Lee, chief analyst at Bitget Research, told Decrypt that he predicts XRP could climb as high as $0.86 before the end of the year.

“XRP has recently been fluctuating between $0.60 and $0.70. Analysts suggest that if it can surpass the resistance level at $0.68, there is potential for further price increases,” he said.

With the imminent change of leadership in United States politics, XRP traders are optimistic that the SEC may soon stop insisting in court that XRP is a security. President-elect Donald Trump said he would “fire Gary Gensler on day one,” referring to the chairman who led the regulator on its crypto crusade.

Trump can’t actually fire Gensler, but analysts are now hypothesizing he will voluntarily leave his post in the next 6 months.

Likely, whoever would take Gensler’s place and be chosen by the very crypto-friendly Trump will be much less inclined to pursue Ripple. Jeremy Hogan—attorney and partner at legal firm Hogan & Hogan—wrote in a recent tweet that he expects Gensler to step down and the new chairman to dispose of all non-fraud crypto cases.

“The litigation team looks at each case and recommends to either settle or dismiss each, and brings their recommendations to the Commissioners who then vote yay or nay,” he suggested. The process would take time, but he believes it may conclude before summer. Regarding Ripple’s specific case, he expects it to be settled for the judgment amount of $125 million.

“It would be…awkward to settle for less than what was already awarded by a Court,” Hogan concluded.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Adrian Zmudzinski

https://decrypt.co/291396/xrp-traders-etf-analysts

2024-11-13 10:59:22