XRP has been consolidating under key resistance for over a month, frustrating investors as the altcoin struggles to gain upward momentum.

This prolonged stagnation has impacted trader confidence, with many opting to step back amid a lack of significant price growth.

XRP Traders Are Uncertain

Open Interest (OI) in XRP Futures dropped by $1 billion in the past 24 hours, signaling a loss of trader conviction. Just a day earlier, OI had surged to $2.9 billion, fueled by expectations of a price rally. However, when these hopes failed to materialize, traders began pulling their money out.

This sudden withdrawal indicates a growing bearish sentiment among XRP enthusiasts. The decline in OI highlights the increasing skepticism surrounding XRP’s ability to break through its current resistance levels, potentially dampening market activity further in the short term.

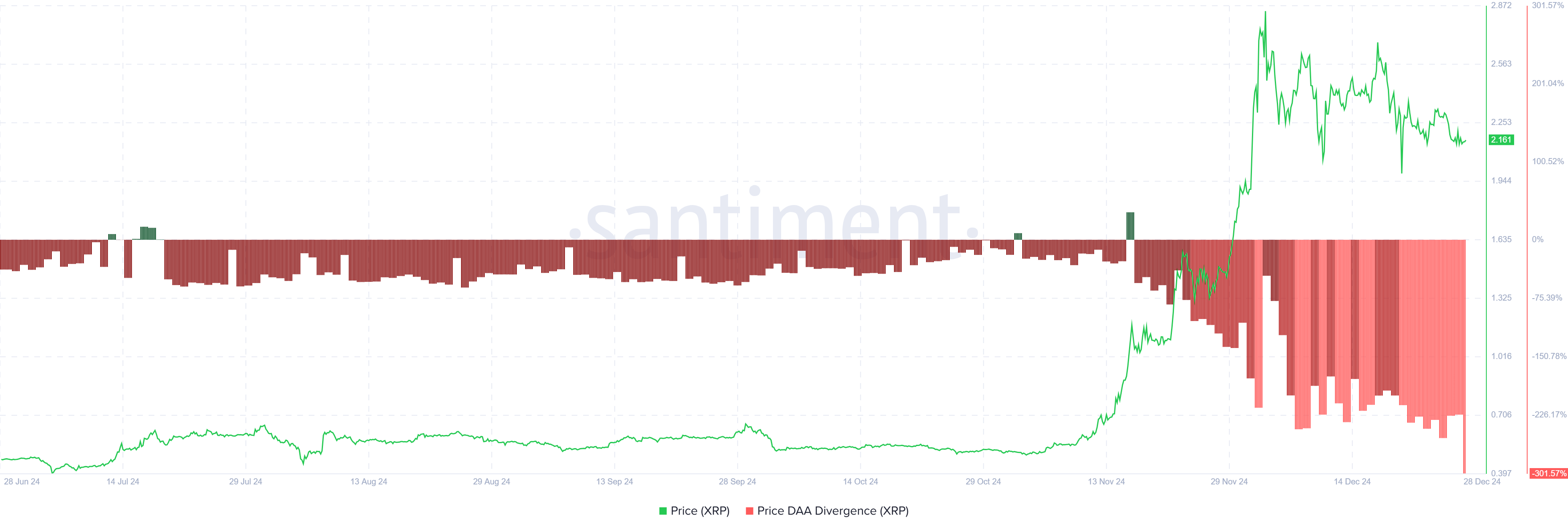

XRP’s macro momentum is also showing signs of weakness. The Price DAA Divergence is currently flashing a sell signal, reflecting declining participation and stagnant price movement. This bearish indicator suggests that traders may begin to secure profits, which could lead to further price declines.

If selling pressure intensifies, XRP could face additional challenges. The combination of reduced participation and hesitant investors may stall the altcoin’s recovery, keeping it locked in a consolidation phase until stronger market cues emerge.

XRP Price Prediction: Escaping The Consolidation

XRP’s price has fallen by 20% over the past month but has managed to hold above the $2.00 support level. Despite this, the altcoin remains consolidated under the critical resistance of $2.73, unable to break through and initiate a rally.

If the bearish factors persist, XRP could continue consolidating with a risk of losing its $2.00 support. Such a scenario would further undermine investor confidence and place additional downward pressure on the price, extending the current stagnation.

Conversely, if broader market conditions turn bullish, XRP could breach the $2.73 resistance and aim for its all-time high of $3.31. Achieving this level would invalidate the bearish thesis and signal a renewed uptrend, attracting more investors back to the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-price-unchanged-after-oi-drop/

2024-12-28 13:15:00