Ripple (XRP) price has shown significant movement recently, with a notable surge in November propelling it to its highest levels since 2018. Now the fourth-largest cryptocurrency by market cap, XRP is within 3% of overtaking Tether for the third spot.

Following last month’s strong performance, XRP has entered a slight consolidation phase, declining 2% over the past week. Technical indicators currently suggest a balance between bullish and bearish momentum.

XRP RSI Is Currently Neutral

Ripple price recently reached its highest price level since 2018 but has dipped 2% over the past week. During its December surge, the Relative Strength Index (RSI) stayed above 70 for several days, signaling overbought conditions driven by strong bullish momentum.

Currently, XRP RSI stands at 46.3, indicating neutral momentum. RSI, a key technical indicator, measures the speed and magnitude of price changes on a scale from 0 to 100.

Readings above 70 suggest overbought conditions, while levels below 30 point to oversold scenarios. With XRP’s RSI near the midpoint, the asset is neither strongly bullish nor bearish, leaving room for price movements in either direction depending on the upcoming days.

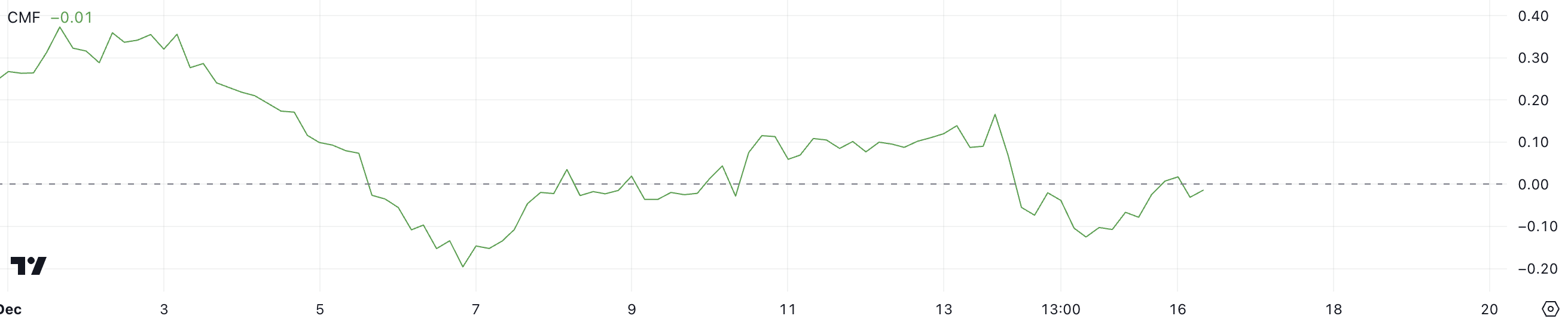

Ripple CMF Is Still Negative, But Recovering

XRP Chaikin Money Flow (CMF) currently stands at -0.01, recovering from -0.13 just two days ago. This improvement suggests a reduction in selling pressure, with money flow into XRP becoming more balanced after a period of outflows.

While still slightly negative, the shift indicates stabilizing sentiment in the market.

The CMF is a technical indicator that measures buying and selling pressure by combining price and volume data. Values above 0 suggest strong buying pressure, while negative values indicate selling dominance. Between November 28 and December 5, Ripple CMF remained highly positive, peaking at 0.37 on December 1, reflecting significant bullish activity during that time.

With the CMF now near neutral territory at -0.01, XRP price could see limited short-term movement unless a decisive trend emerges from renewed buying or selling momentum.

XRP Price Prediction: Will the $2.17 Support Hold?

XRP EMA lines indicate price consolidation, with short-term averages still above long-term ones but the gap narrowing. This signals weakening bullish momentum, which could lead to a downtrend if selling pressure increases.

In such a scenario, XRP price might test the support at $2.17, with a further decline possibly bringing it down to $1.89 if the initial support fails.

On the other hand, a recovery in the uptrend could see Ripple price challenging resistance at $2.64. Breaking through this level would open the door for a potential move toward $2.90, reinforcing bullish sentiment.

The narrowing EMA lines highlight a pivotal moment for XRP, with upcoming moves depending on whether buyers or sellers gain the upper hand.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-price-consolidates/

2024-12-16 15:30:00