XRP recently attempted to form a new all-time high (ATH) of $3.40 but failed, retreating to its current price of $3.15. This drop comes amid mounting bearish momentum on the charts.

Investors have further worsened the situation, with declining participation adding pressure to the altcoin’s performance.

XRP Is Facing Pressure

The Price Daily Active Addresses (DAA) Divergence is flashing a clear sell signal, reflecting a decline in investor activity on the XRP network. The reduced transaction volume is a cause for concern, as it highlights diminishing confidence in the altcoin. The presence of red bars on the DAA Divergence indicates a strong sell signal, warning investors of potential price drops.

If investors continue to pull back from network activity, XRP’s price could face increased selling pressure. The lack of strong transactional engagement weakens support levels, making the altcoin vulnerable to sharp corrections. Without renewed interest from participants, XRP’s recovery may remain limited in the short term.

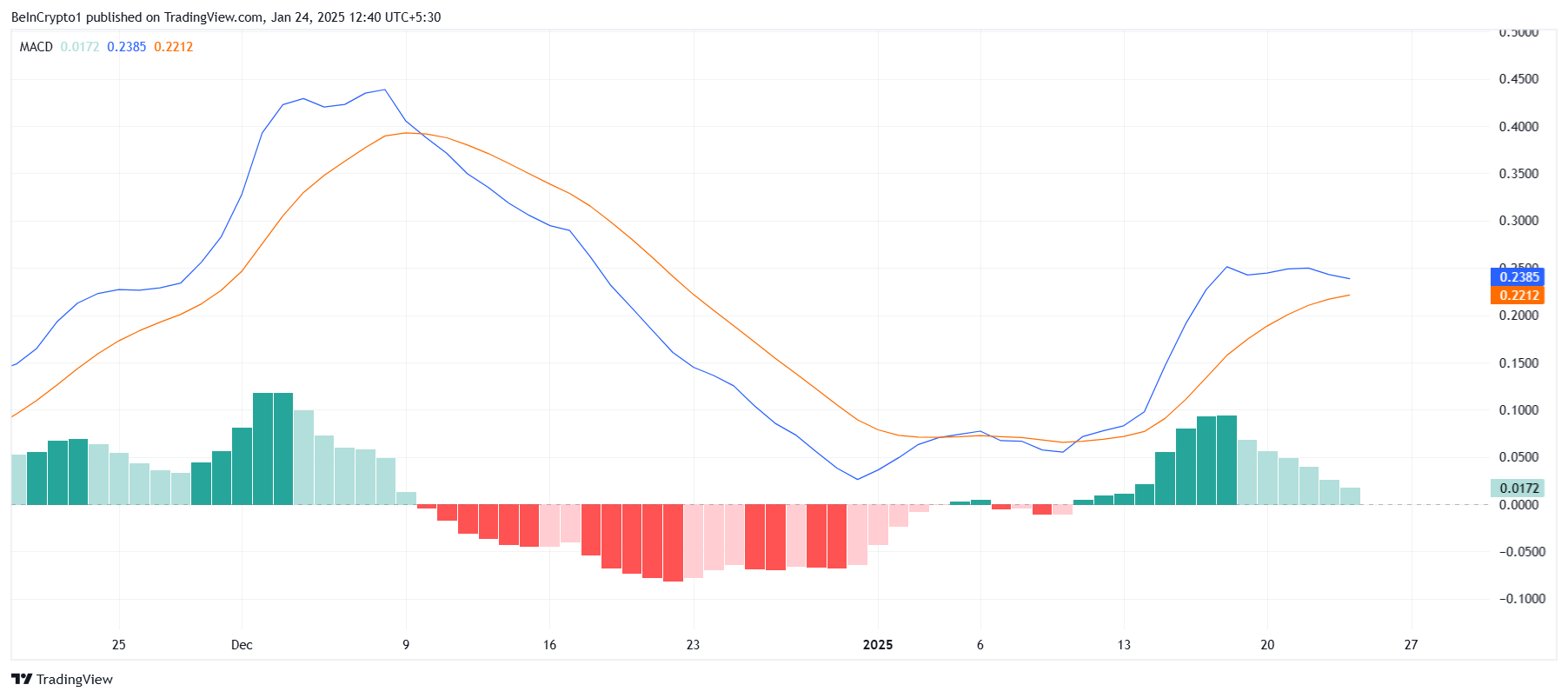

XRP’s macro momentum is signaling further downside risks. The Moving Average Convergence Divergence (MACD) is on the verge of a bearish crossover. This technical indicator suggests that selling momentum is overtaking buying pressure, raising concerns among traders.

Additionally, the histogram bars on the MACD are receding. A drop below the zero line would confirm that bearish momentum has firmly taken hold. This aligns with the broader market trend, which remains uncertain, compounding the challenges for XRP’s price action.

XRP Price Prediction: Breaking Highs

XRP is trading at $3.15 after reaching its ATH of $3.40 earlier this month. Despite several attempts to sustain a rally, the altcoin is struggling to maintain upward momentum. Bearish sentiment and declining investor activity continue to weigh on its price trajectory.

If the bearish factors persist, XRP could decline to its critical support level of $2.73, marking a 13% correction. Failure to hold this support could lead to further losses, potentially pushing the price down to $2.18. Such a drop would erase recent gains, reinforcing the bearish outlook.

On the flip side, if XRP manages to secure $2.73 as a strong support, it could regain its footing. A bounce from this level might enable the altcoin to breach the $3.40 ATH barrier. If successful, XRP could form new highs, effectively invalidating the bearish scenario and reigniting investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Aaryamann Shrivastava

https://beincrypto.com/xrp-price-faces-correction-investors-pull-back/

2025-01-24 09:00:00