XRP price has entered a consolidation phase over the past seven days, following a historic rally during November and December that saw it reach its highest levels in six years. Whale activity has stabilized, with the number of wallets holding between 10 million and 100 million XRP recovering to 301 after a month-low of 292 on December 18.

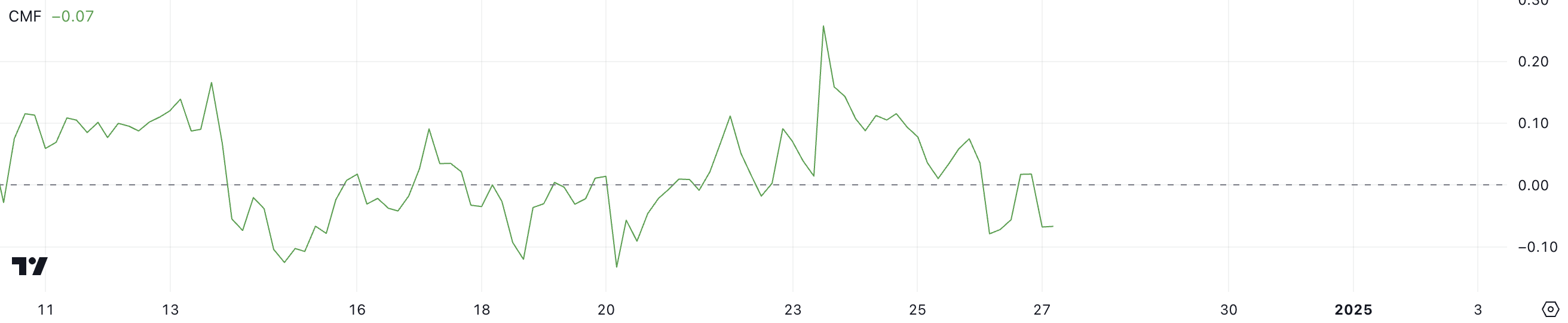

Meanwhile, the Chaikin Money Flow (CMF) has turned slightly negative at -0.07, reflecting mild selling pressure after briefly turning positive. As XRP hovers around key support levels, market indicators point to a mixed short-term outlook, with both upward and downward scenarios in play.

XRP Whales Are Accumulating Again

The number of XRP whales holding between 10 million and 100 million tokens has stabilized at 301, up from 296 on December 24. This follows a recovery from a month-low of 292 on December 18, signaling renewed accumulation by large holders.

The stabilization suggests a possible pause in whale activity after a period of fluctuation, with these key participants potentially positioning themselves for upcoming market developments.

Tracking whale activity is significant because these large holders often influence price trends due to the volume of their trades. The recovery and stabilization in whale numbers could indicate confidence among major investors. That could potentially support XRP price in the short term.

If whales continue to hold or accumulate, it may create a foundation for bullish sentiment. At the same time, any reduction in their holdings could signal caution or upcoming sell-offs, affecting XRP price.

XRP CMF Turns Negative After Briefly Turning Positive

XRP’s Chaikin Money Flow (CMF) has dropped to -0.07, a decline after reaching 0.02 yesterday. This follows a notable peak of 0.26 on December 23, coinciding with a sharp price increase from $2.13 to $2.26 in just a few hours.

The shift in CMF highlights changing levels of buying and selling pressure in the market over the past few days.

The CMF measures the flow of money into and out of an asset, with positive values indicating buying pressure and negative values showing selling pressure. XRP CMF at -0.07 suggests a slight dominance of selling pressure over buying. In the short term, this could mean the price may face resistance to upward movement unless buying activity strengthens.

However, the relatively mild negative value also implies that selling pressure is not yet overwhelming. This potentially signals a period of consolidation rather than a sharp downturn.

XRP Price Prediction: Will the $2.13 Support Be Tested Again?

XRP price recently tested the support level at $2.13 and managed to hold it, leading to a slight price rebound. While the token hasn’t entered a clear uptrend, further upward momentum could see it testing resistance at $2.33.

If the trend strengthens, XRP might aim for higher targets at $2.53 or even $2.64, presenting key levels for potential bullish continuation.

However, whale activity and the Chaikin Money Flow (CMF) indicate a lack of clear market direction.

If the $2.13 support is tested again and fails to hold, XRP could face a decline toward $1.96 or even $1.89.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-price-stalls-whales-recover/

2024-12-27 13:00:00