XRP price has surged 10% in the last 24 hours, with its trading volume skyrocketing nearly 50% to $8 billion. This strong momentum has pushed XRP’s Relative Strength Index (RSI) back into overbought territory for the first time in almost a month. That surge happened after the SEC accepted its ETF filling, although this doesn’t mean it was approved yet.

Meanwhile, whale activity remains stagnant, with the number of large holders showing only slight movement after a recent surge and decline. As XRP hovers near key resistance levels, traders are watching closely to see whether this rally has the strength to continue or if a correction is on the horizon.

XRP RSI Is Back to Overbought After Almost a Month

XRP’s Relative Strength Index (RSI) has surged to 72.2, climbing from 50 just a day ago.

This sharp increase highlights strong bullish momentum in XRP price action. For the first time in nearly a month, traders have pushed the asset into overbought territory.

Such a rapid rise in RSI suggests intensified XRP buying pressure, signaling that demand has significantly outpaced supply in the short term.

The RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Typically, an RSI above 70 suggests an asset is overbought and may be due for a pullback, while an RSI below 30 indicates oversold conditions, potentially leading to a rebound.

With XRP now in overbought territory, the likelihood of a short-term correction increases as traders might start securing profits. However, if buying pressure persists and RSI remains elevated, it could indicate the start of a stronger bullish trend, pushing XRP to higher resistance levels.

XRP Whale Activity Is Stagnant

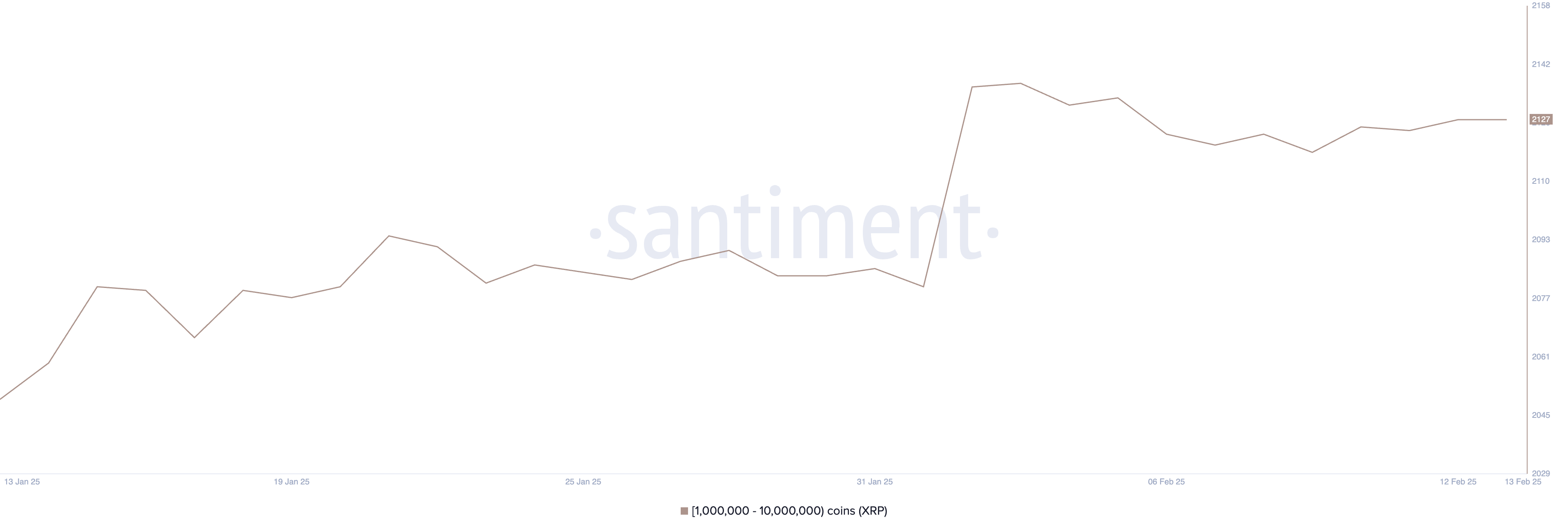

The number of XRP whales – wallets holding between 1 million and 10 million XRP – jumped from 2,081 to 2,136 between February 1 and February 2, signaling strong accumulation.

However, this surge was short-lived, as the count began to decline, reaching 2,118 by February 9. Such movements suggest that while some large holders were accumulating, others may have started taking profits or redistributing their holdings.

Tracking whale activity is important because these large holders can significantly impact price action. After the recent decline, the number of whales has started rising again, but at a slow pace, currently at 2,127.

This suggests some renewed accumulation, but the near-stable trend in recent days indicates hesitation. Without stronger buying activity, XRP may remain in consolidation rather than gaining upward momentum.

XRP Price Prediction: Will XRP Recover $3 Levels In February?

XRP price has surged over 10% in the last 24 hours, showing strong bullish momentum. Its EMA lines suggest that golden crosses could form soon, which often signal further upside.

If the uptrend continues, XRP could test a key resistance at $2.96, and if broken, it may push toward $3.15. A strong breakout could even drive XRP to $3.36, representing a potential 24.5% gain. That could be driven by the approval of XRP ETF by the SEC, which could happen soon.

However, if the uptrend loses momentum, XRP price could face a pullback, testing support at $2.54.

A break below this level might lead to further downside toward $2.26, and if selling pressure intensifies, XRP could drop as low as $1.77.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-price-surges-golden-cross-upside/

2025-02-14 20:00:00