XRP price is down 6% over the last seven days but has managed to recover 3% in the past 24 hours, signaling potential stabilization. The RSI has risen to 46.5, moving out of oversold territory, while whale activity remains stable after a brief accumulation phase during Christmas.

These indicators suggest cautious market sentiment, with XRP trading between resistance at $2.13 and support at $1.96. Whether XRP can maintain its recovery or face further declines will depend on breaking key resistance levels or avoiding a potential death cross on its EMA lines.

XRP RSI Recovered From an Oversold Zone

XRP Relative Strength Index (RSI) is currently at 46.5, recovering from an oversold level of 30 that it touched between December 30 and December 31. This rebound suggests that selling pressure has eased, and the price is attempting to stabilize.

An RSI of 46.5 indicates that momentum remains slightly bearish but is moving toward a neutral zone, signaling potential indecision among traders as XRP price tries to maintain its position above $2.

The RSI is a momentum indicator that measures the speed and magnitude of price movements on a scale of 0 to 100. Readings above 70 indicate overbought conditions, often signaling a potential price pullback, while readings below 30 suggest oversold conditions and the possibility of a price recovery.

With XRP RSI at 46.5, it sits in a neutral range, neither signaling strong upward nor downward momentum. In the short term, this could mean that XRP is in a consolidation phase, where it may hover near current levels unless a significant shift in buying or selling pressure occurs.

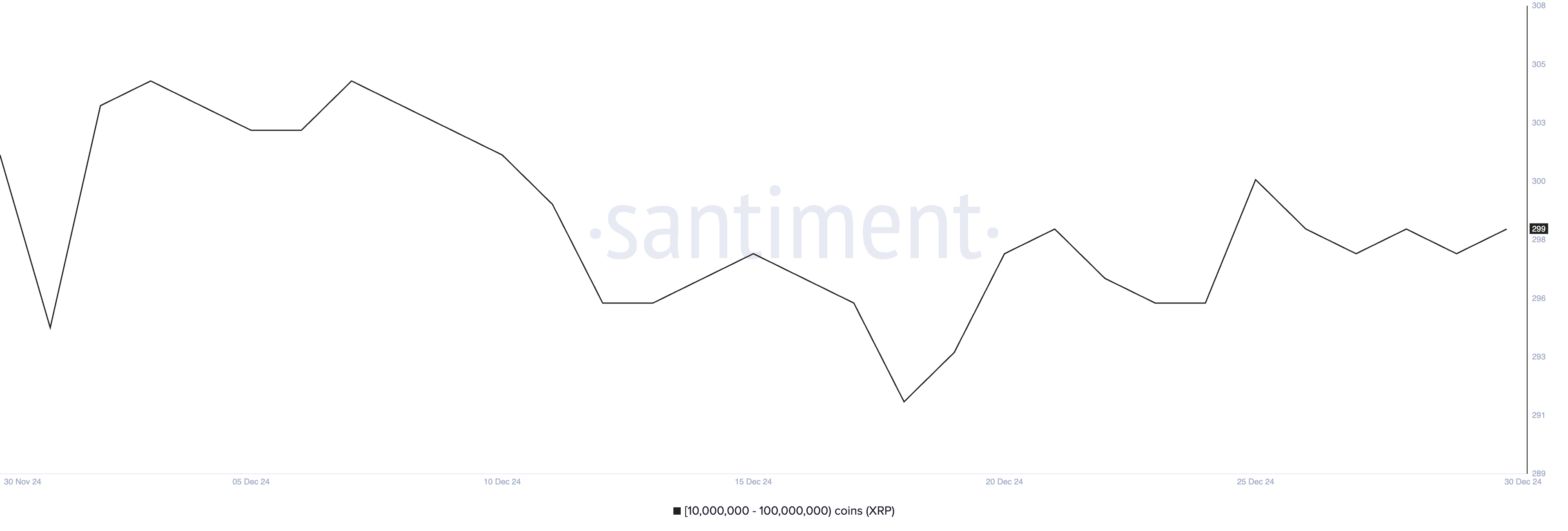

Whales Accumulated XRP During Christmas

The number of XRP whales—addresses holding between 10 million and 100 million XRP—has remained stable in recent days. These addresses saw a brief increase from 296 to 301 between December 24 and December 25, signaling a short-term accumulation phase.

However, the number declined slightly and has hovered around 298 to 299 since December 26, indicating a period of stabilization in whale activity. This steady behavior suggests that large investors are neither aggressively accumulating nor selling XRP at the moment.

Tracking whale activity is crucial because these large holders often significantly impact market dynamics. Their buying can create upward momentum, while their selling can apply downward pressure.

The current stabilization in the number of whales suggests a cautious approach, reflecting a neutral sentiment among major investors. In the short term, this could mean that XRP price may remain range-bound, with minimal volatility, unless whale activity shifts decisively toward accumulation or distribution.

XRP Price Prediction: Will It Stay Above $2?

XRP price is currently trading within a narrow range, with a resistance level at $2.13 and support at $1.96, as it works to maintain its position above $2.

If the resistance at $2.13 is tested and broken, XRP price could see further upward momentum, potentially targeting $2.33. Should the uptrend gain additional strength, the price might climb as high as $2.53, signaling a stronger bullish phase.

However, the EMA lines suggest caution, as a potential death cross could form soon, indicating a bearish shift in momentum.

If this bearish setup materializes, XRP price may lose the critical $1.96 support and test $1.89. A failure to hold above this level could push the price down further to $1.63, marking a significant decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-price-faces-key-levels/

2024-12-31 14:30:00