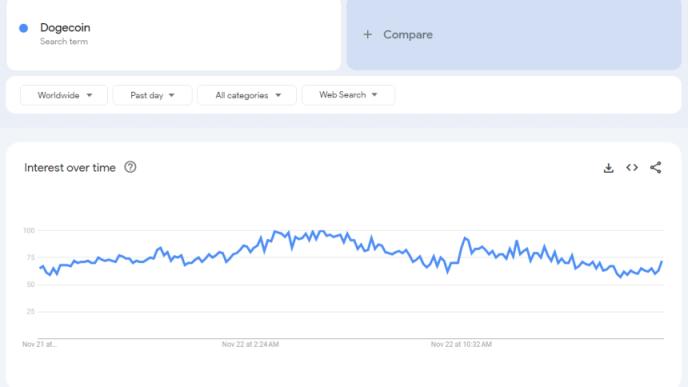

As Securities and Exchange Commission (SEC) Chair Gary Gensler prepares to leave his post behind, a cryptocurrency targeted under his leadership is staging a notable climb.

Used prominently by fintech firm Ripple Labs, the price of XRP popped Thursday as Gensler said he would resign from his leadership position at the agency when President-elect Donald Trump takes control of the White House in January.

As of this writing, XRP’s price has increased 20% over the past day, with the asset reaching its highest price since May 2021 at $1.49 earlier Friday.

While XRP has been one of the largest cryptocurrencies by market capitalization since its launch in 2013, the SEC alleged the asset is a security in a lawsuit brought in 2020. Even though a federal judge had since ruled that the token is “not necessarily a security on its face,” a sense of regulatory uncertainty persisted, with the SEC appealing the decision.

Bitwise Senior Investment Strategist Juan Leon told Decrypt that XRP’s jump in price is rooted in hopes of a favorable regulatory environment under Trump. While the SEC has hounded Ripple Labs in court for years, a change in leadership could bring about new opportunities, depending on whether the SEC decides to abandon its four-year lawsuit.

“Ripple Labs, and XRP by extension, has been mired in lawsuits with the SEC since 2020, which has severely held back [their associated] business prospects,” he said. “Now, with Gensler on his way out and XRP’s stablecoin launching, investors are embracing a clear roadmap for XRP to fulfill its mission as a B2B blockchain payments network.”

On Election Day, the price of XRP hovered around $0.50. Since Trump’s election win, however, the cryptocurrency’s price has nearly tripled, becoming one of crypto’s biggest post-election gainers.

Ripple CEO Brad Garlinghouse has meanwhile offered Trump’s camp advice, per the New York Times. The outlet reported last week that Garlinghouse has spoken to people close to the president-elect about staffing decisions under Trump’s new administration.

With a change in SEC leadership likely to bring about a crypto-friendly regime, investors’ access to XRP has recently broadened in the U.S. Earlier this month, for example, the investment app Robinhood listed the token for trading on its platform.

Last month, Ripple’s Chief Legal Officer Stuart Alderoty claimed to Decrypt that Gensler wanted to keep “a cloud of uncertainty hanging over the industry” with its slated appeal. Still, he argued that the SEC’s appeal would likely fail, dispelling that cloud of uncertainty for good.

While the SEC had sought a $2 billion penalty against Ripple over XRP sales, claiming the firm had violated securities laws, a federal judge ordered Ripple to pay a $125 million fine over XRP in August. The judge found that XRP sales to institutions had violated securities laws but not programmatic ones that made the token available to retail investors.

Connor McGlaughlin, a YouTube influencer and XRP investor who has dedicated his Mickle Markets channel to boosting the cryptocurrency, told Decrypt that he believes the coin is rising as fears fade over its regulatory status.

As the SEC’s lawsuit appears more embattled than ever, McGlaughlin—who has posted pro-XRP videos in relation to Gensler in recent days—sees renewed optimism among fellow supporters.

“With the likelihood of a favorable resolution and the potential for a more crypto-friendly regulatory environment under a new administration, confidence in XRP is growing,” he said. “The market is waking up to this potential, driving the current excitement and price momentum.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

André Beganski

https://decrypt.co/293259/xrp-price-3-year-high-sec-shakeup

2024-11-22 22:47:33