XRP has been stuck in a prolonged consolidation phase, preventing the altcoin from reaching the $3.00 mark this year.

As January 2025 approaches, the likelihood of XRP achieving this milestone remains slim, with market conditions and technical indicators suggesting a delay in any substantial rally.

XRP Is Facing Trouble

The NVT (Network Value to Transaction) Ratio indicates that XRP’s network value is currently outpacing its transactional value. Historically, this imbalance has preceded corrections, as inflated network valuations are often followed by losses for investors.

Such market conditions create an environment where recovery becomes challenging. Without increased transactional activity to support its network value, XRP faces heightened risks of prolonged stagnation or potential downward movement, limiting its short-term growth prospects.

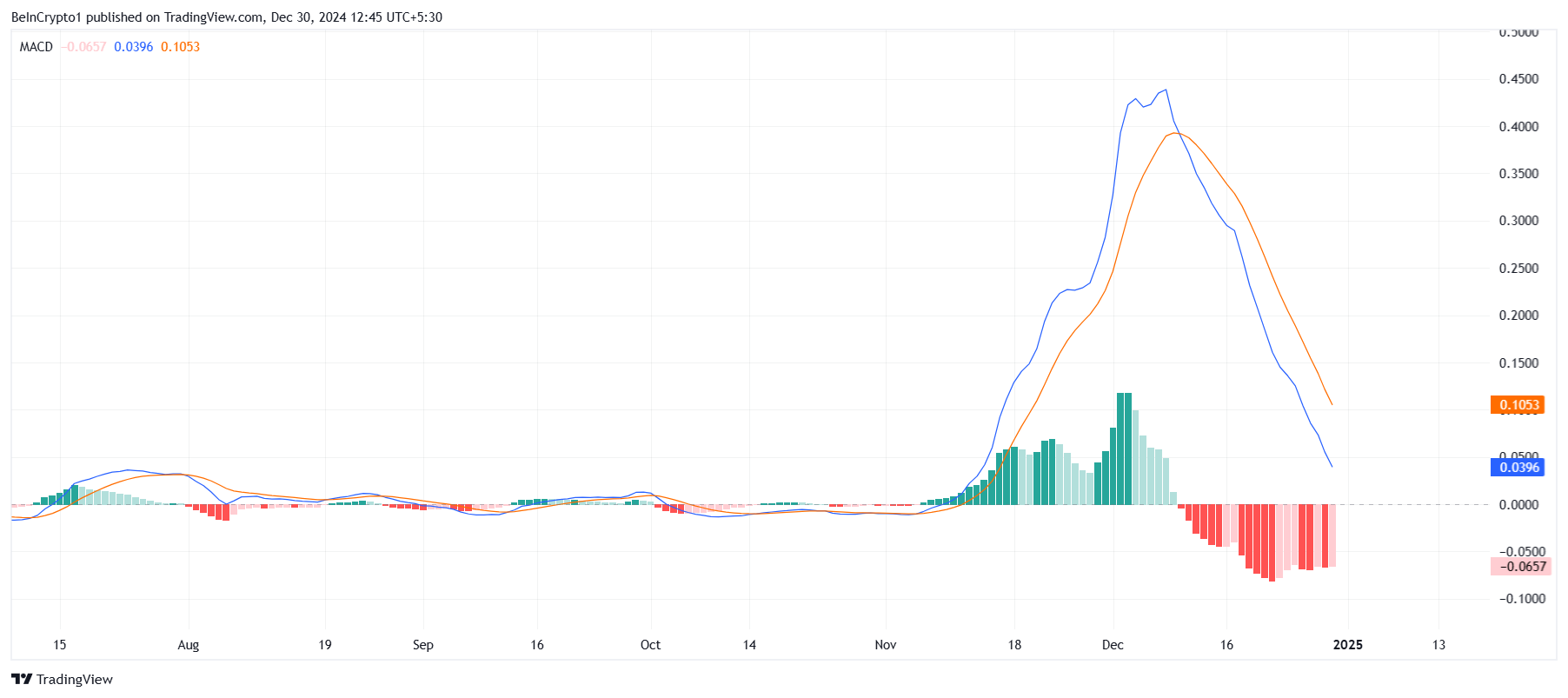

The MACD (Moving Average Convergence Divergence) indicator adds to the bearish outlook, with no signs of a bullish crossover in sight. This lack of momentum is unlikely to change as 2025 begins, with the bearish crossover reflecting broader negative market cues.

This technical indicator suggests a continuation of the downward pressure on XRP. Until a reversal occurs, the altcoin may struggle to break out of its current consolidation range and could face further declines if selling pressure intensifies.

XRP Price Prediction: Staying Afloat

XRP has been consolidating for the past month, remaining trapped below the $2.73 resistance level while hovering above the $2.00 support. This pattern mirrors a prior consolidation period that lasted over three months before XRP finally rallied in November this year, raising the possibility of a similar timeline.

If history repeats itself, XRP may not break $3.00 until the end of February 2025. During this extended consolidation, any significant selling could push the altcoin to as low as $1.28, compounding losses for investors.

However, a shift in broader market sentiment could change XRP’s trajectory. Breaching the $2.73 resistance level would likely push the price to $3.00, invalidating the bearish outlook and signaling a renewed bullish phase for the altcoin that could even push XRP to a new all-time high beyond $3.31.

The post XRP Struggles to Break $3.00 Amid Prolonged Market Consolidation appeared first on BeInCrypto.

Source link

Aaryamann Shrivastava

https://beincrypto.com/no-xrp-price-ath-by-new-year/

2024-12-30 08:00:55