XRP is up more than 7% in the last 24 hours, bringing its market cap near $150 billion. The crypto community is now debating how its inclusion in the US crypto strategic reserve will impact its long-term price action.

Attention is also on the upcoming White House Crypto Summit on March 7, which could play a key role in shaping market sentiment. Whether XRP continues its rally or faces new resistance will depend on these developments and whether technical indicators confirm a sustained uptrend.

XRP DMI Shows Buyers Are Still In Control

XRP’s DMI shows that its ADX is currently at 18.49, down from 36.2 four days ago, indicating that the strength of its trend has weakened significantly.

The +DI (positive directional index) is at 25.1, down from 50, while the -DI (negative directional index) has risen to 14.4 from 9.3.

This shift suggests that bullish momentum has faded while selling pressure has slightly increased, making it harder for XRP to establish a strong uptrend.

The Average Directional Index (ADX) measures trend strength on a scale from 0 to 100, with readings above 25 signaling a strong trend and values below 20 indicating weak or nonexistent momentum.

XRP’s ADX at 18.49 suggests that its current attempt to form an uptrend lacks strength. The declining +DI shows buyers could be losing control, while the rising -DI indicates sellers are gaining ground.

If this trend continues, XRP may struggle to sustain an upward move, but if ADX picks up again and +DI rebounds, bullish momentum could return.

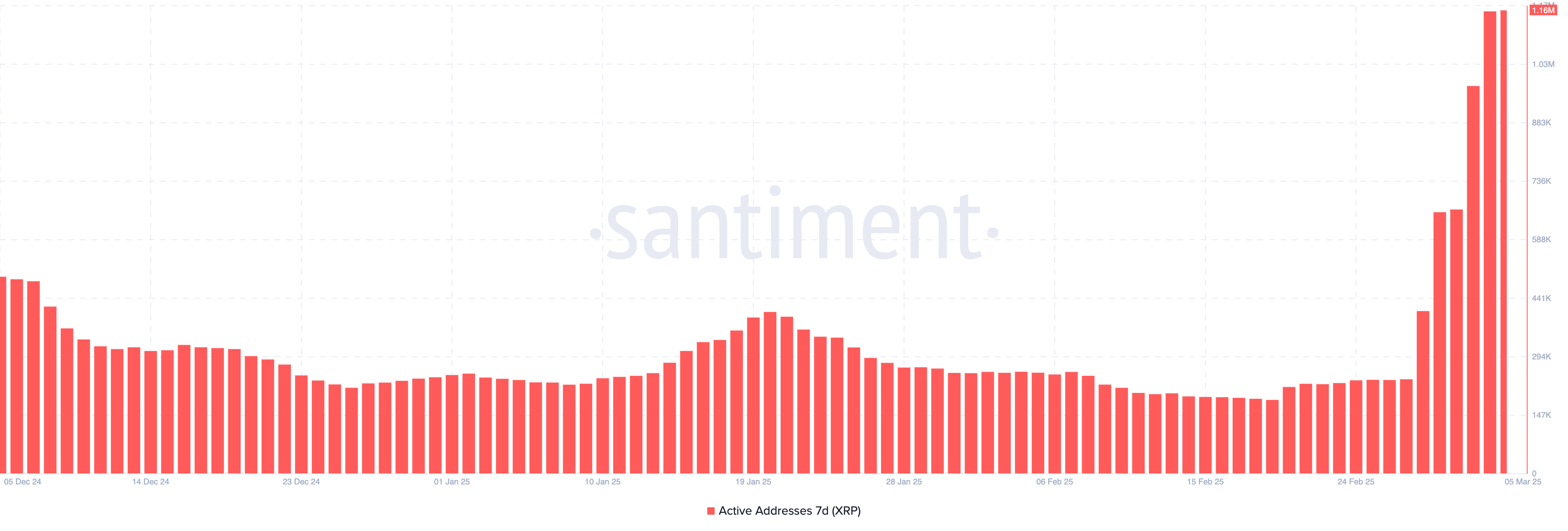

XRP Active Addresses Just Hit A New All-Time High

XRP’s 7-day active addresses have surged to 1.16 million, marking their highest level ever.

This sharp increase comes after the metric stood at just 236,000 on February 27, indicating a significant rise in network activity over the past few days.

Tracking active addresses is important because it reflects user engagement, transaction activity, and overall demand for a cryptocurrency.

A rising number of active addresses often signals increased adoption and interest, which can support price growth. Despite the crypto community questioning whether XRP should be included in the US crypto strategic reserve, this spike in activity suggests strong network participation.

If this trend continues, it could help sustain bullish momentum for XRP, potentially driving prices higher.

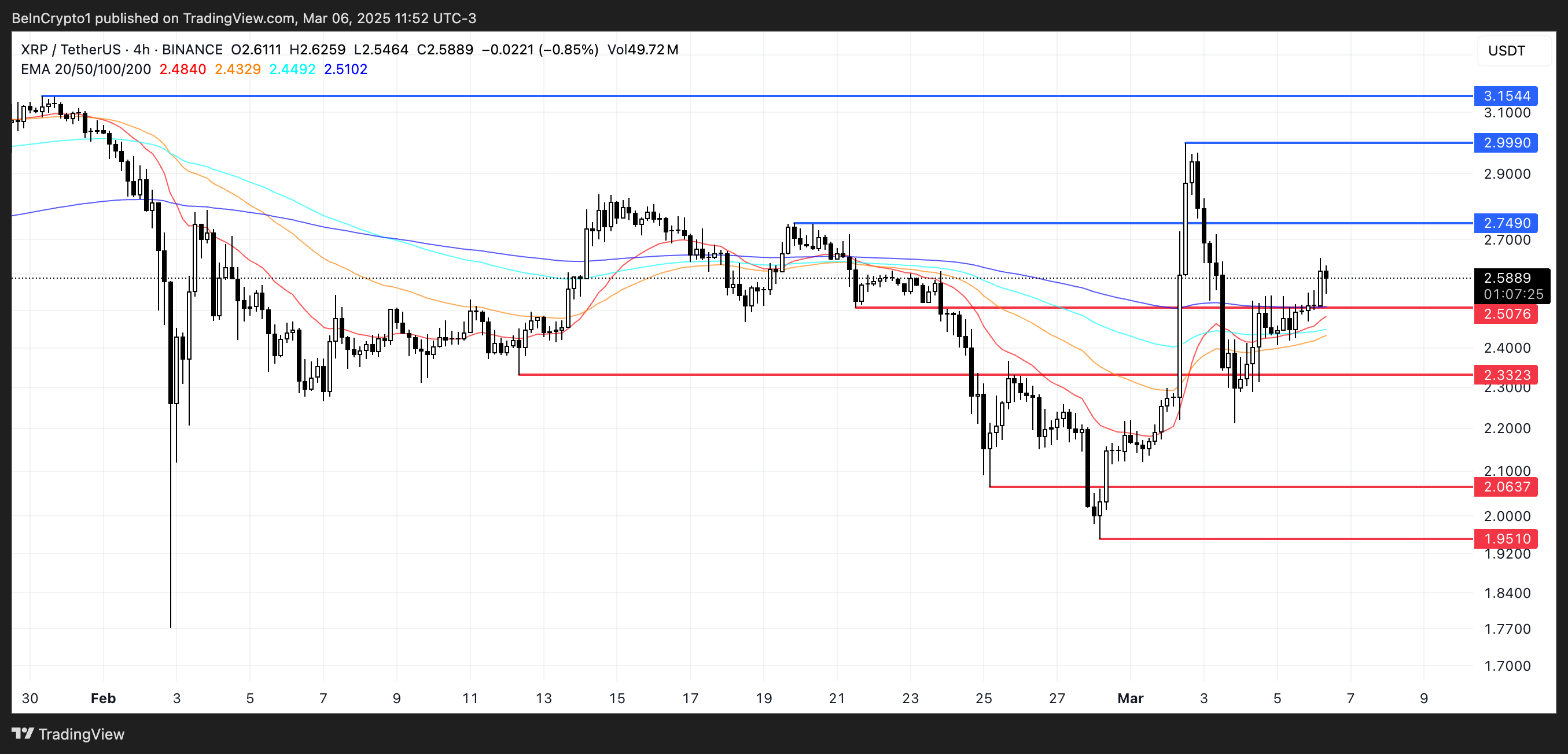

Will A Golden Cross Make XRP Surge Soon?

XRP’s EMA lines indicate that a golden cross could form soon, as short-term moving averages continue to rise. If this bullish signal materializes, XRP price could test resistance at $2.74, with a breakout potentially sending the price to $2.99 and even $3.15.

However, this will depend on key developments, including the next steps regarding the US crypto strategic reserve and potential announcements at the White House Crypto Summit on March 7.

Tracy Jin, COO of MEXC, told BeInCrypto:

“The approach to establishing strategic reserves is contentious and may require either an executive order or Congressional authorization, potentially undermining long-term policy stability. While Trump’s initiatives are expected to boost market confidence and attract institutional investments in the short term, uncertainties remain over policy effectiveness, Congressional support, and international market reactions in the medium to long term. Investors should monitor these developments closely and adjust their strategies accordingly.”

On the other hand, if it fails to build an uptrend and selling pressure increases, it could test support at $2.50, with a further drop potentially pushing it to $2.33.

A stronger downtrend could drive prices to $2.06 or even below $2, testing $1.95.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Tiago Amaral

https://beincrypto.com/xrp-surges-golden-cross-signals/

2025-03-06 19:00:00