XRP large investors or whales amassed 1.08 billion tokens valued at $3 billion at current market prices during Thursday’s early Asian session. This has pushed the total XRP holdings of the whale cohort to its highest level since June 2024.

Despite this, XRP’s price has remained rangebound, reflecting the significant bearish bias against it.

Developments Within Ripple Fail to Excite XRP Bulls

According to Santiment, whale addresses that hold between 100,000,000 and 1,000,000,000 XRP have collectively acquired 1.08 billion tokens worth $3 billion today. This has pushed the group’s entire holdings to 10.41 billion XRP, its highest since June 2024.

This surge in whale accumulation comes amidst a backdrop of positive developments within the Ripple ecosystem. These include the recent integration with Chainlink, Ripple CEO Brad Garlinghouse, and Chief Legal Officer Stuart Alderoty’s dinner with pro-crypto President-elect Donald Trump, and Ripple President Monica Long’s recent interview, in which she confirmed that an XRP exchange-traded fund (ETF) may soon materialize.

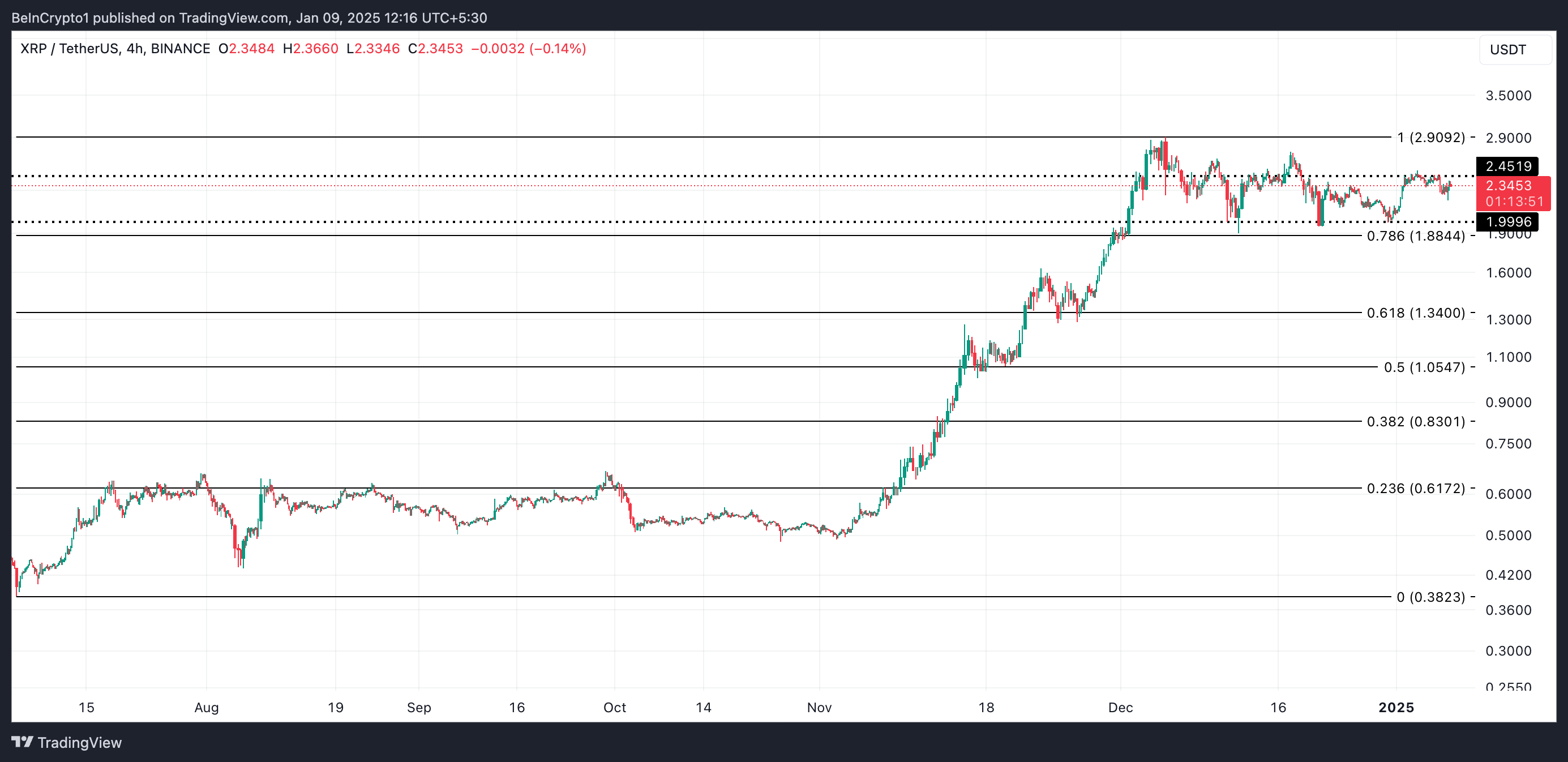

However, despite this significant whale activity, XRP’s reaction has remained muted, with its price trending sideways. Technical indicators assessed on a four-hour chart confirm the bearish sentiment that continues to prevent the token’s upward break out.

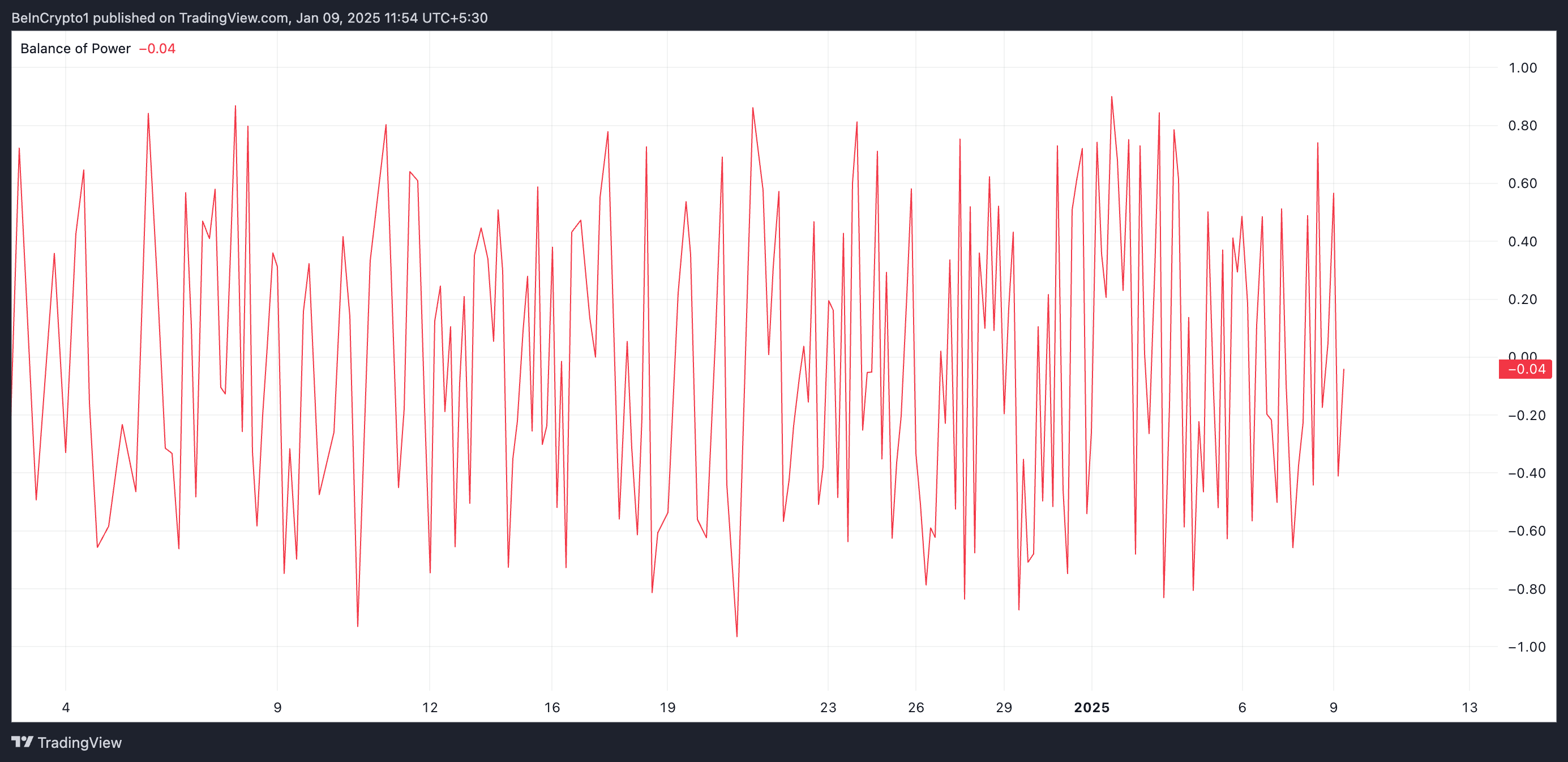

First, its Balance of Power (BoP) is below one at -0.04 at press time. This indicator measures the strength of buyers versus sellers by analyzing price movements within a specific period.

When its value is negative, it indicates that sellers are dominating the market, signaling bearish sentiment and downward price pressure.

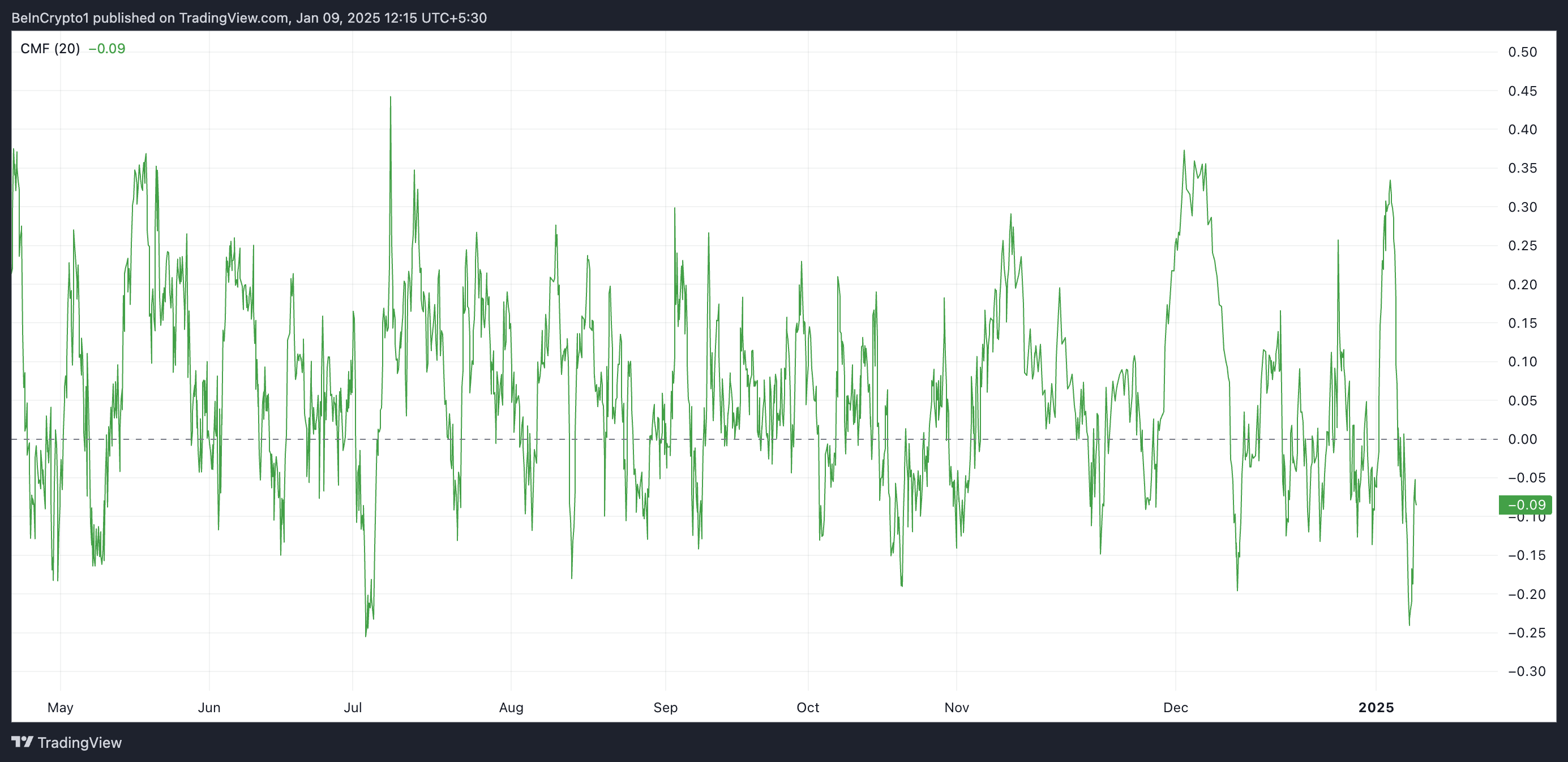

Furthermore, XRP’s negative Chaikin Money Flow (CMF) supports this bearish outlook. As of this writing, this indicator, which tracks the flow of money into and out of the asset, is at -0.09.

When an asset’s CMF is negative, it indicates that selling pressure outweighs buying pressure, reflecting the market’s bearish momentum.

XRP Price Prediction: Key Levels To Watch

According to XRP’s Fibonacci Retracement tool, if this bearish pressure strengthens, the altcoin’s price may test the support at $1.99. If the level fails to hold, the price will extend its decline toward $1.88.

However, if whales continue accumulating, driving a market-wide resurgence in XRP buying activity, its price may rise to $2.45, invalidating this bearish projection.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-stays-rangebound/

2025-01-09 10:30:00