XRP’s price climbed 30% on Sunday after President Donald Trump announced its inclusion as part of the coins that make up his proposed cryptocurrency reserve. According to on-chain data, this announcement drove the altcoin into overvalued territory.

However, the surge was short-lived. A wave of profit-taking has triggered a decline, pushing XRP back into undervalued levels.

XRP’s MVRV Ratio Signals Undervalued Levels

XRP’s Market Value to Realized Value (MVRV) ratios assessed over multiple moving averages suggest that the altcoin is now undervalued. According to Santiment, as of this writing, the token’s seven-day and 30-day MVRV ratios are -6.85% and -6.36%, respectively.

An asset’s MVRV ratio identifies whether it is overvalued or undervalued by measuring the relationship between its market value and its realized value. When an asset’s MVRV ratio is positive, its market value is higher than the realized value, suggesting it is overvalued.

However, as with XRP, when the ratio is negative, the asset’s market value is lower than its realized value. This suggests that the coin is undervalued compared to what people originally paid for it.

Historically, negative MVRV ratios present a buying opportunity. Traders view them as a signal to buy the asset at discounted prices and hold to sell when the market sees a resurgence in bullish pressure. Therefore, XRP’s MVRV ratios currently flash a buy signal for those looking to “buy the dip” and “sell high.”

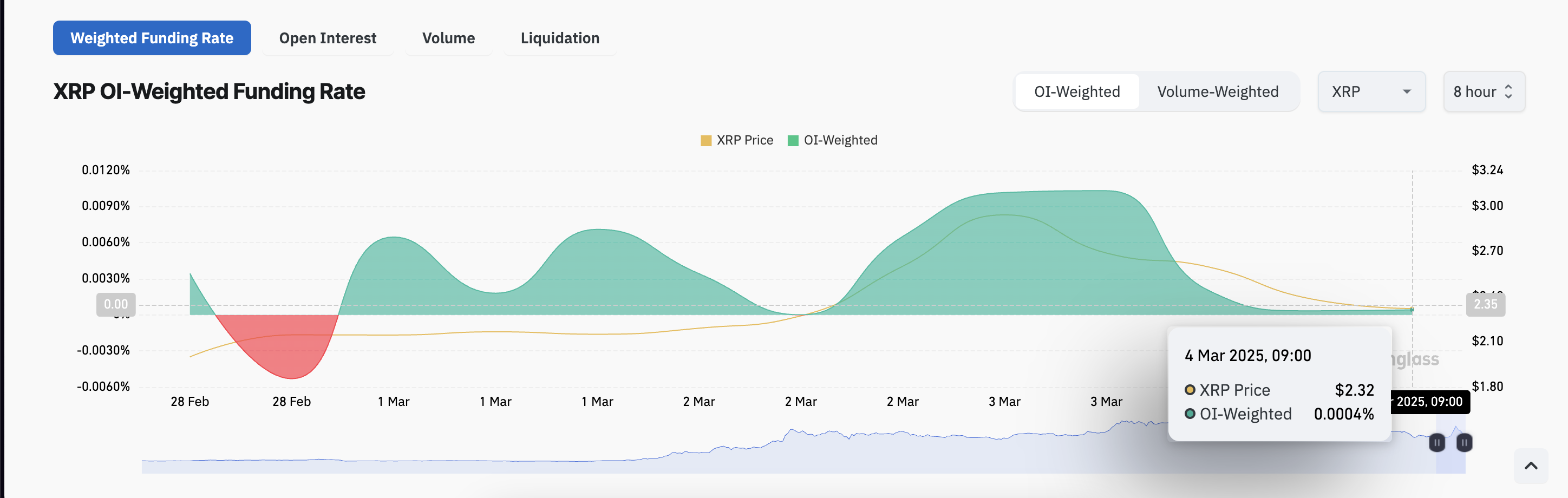

Moreover, despite XRP’s price decline since Sunday’s high, its funding rate remains positive, highlighting the optimism among its futures market participants. At press time, this is at 0.0004%.

The funding rate is the periodic payment exchanged between long and short traders in perpetual futures markets. It is designed to keep the price of a derivative close to the underlying asset.

When the funding rate is positive, traders in the derivatives market are betting on upward price movement.

Is It Time for the Bulls to Take Control?

XRP, down 10% in the past 24 hours, currently trades at $2.37. If market participants heed the buy signal and new demand enters the market, it could propel the altcoin toward resistance at $2.93.

A successful breach of this level could cause XRP to reclaim its all-time high of $3.40, which was last reached on January 16.

On the flip side, if it maintains its current downtrend, XRP’s price could fall to $2.13.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source link

Abiodun Oladokun

https://beincrypto.com/xrp-price-undervalued/

2025-03-04 18:30:00