[PRESS RELEASE – United States, New York, December 16th, 2024]

Backed by Manifold and other notable partners, Yei Finance aims to redefine DeFi lending with cross-chain innovations.

A Notable Milestone on the Path to V2

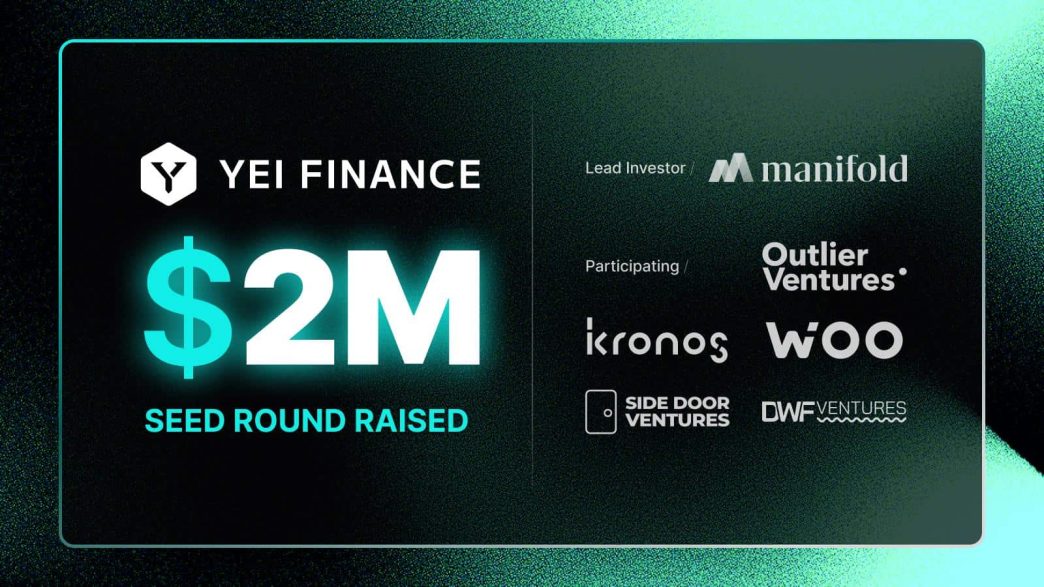

Yei Finance, a growing platform in decentralized lending, has announced the successful close of its $2M seed funding round. Led by Manifold, with additional participation from DWF Ventures, Kronos Research, Outlier Ventures, Side Door Ventures, and WOO, along with prominent industry figures like Matt Dobel (@mattdobel) and 0xZHUANG.

Yei Finance has also extended a special thanks to the Sei Foundation for their support. This investment will support the development of V2, a significant step in building an omnichannel money market that addresses inefficiencies in the current DeFi ecosystem.

What’s Next: The Vision for V2

Yei Finance V2 introduces innovative features aimed at enhancing user experience, scalability, and capital efficiency across blockchains. This next phase is defined by several initiatives.

Modular Lending Markets

Yei Finance is introducing isolated lending pools designed for specific assets, risk profiles, and strategies. These pools will support cross-chain borrowing and lending while yield-bearing tokens like yUSDC will work to enhance capital efficiency. This approach unlocks new liquidity opportunities, giving users flexibility and security.

Yei App Chain with Hub-and-Spoke Architecture

At the heart of Yei Finance’s vision is a dedicated app chain that acts as the protocol’s core. This architecture includes a centralized credit layer for managing collateral, debt, and interest rates, as well as cross-chain governance and incentivized mechanisms. This ensures scalable and secure cross-chain operations, setting a strong foundation for growth.

Omnichain Money Market

Yei Finance is creating a unified liquidity pool that simplifies borrowing and lending across blockchains. By integrating Circle’s CCTP for native USDC transfers, the protocol eliminates reliance on wrapped tokens or third-party bridges. This streamlines capital utilization and reduces liquidity fragmentation, providing a seamless user experience.

Strengthening the DeFi Landscape

Yei Finance is developing critical innovations like smart routing for optimal cross-chain lending and a robust liquidation framework to mitigate systemic risks. These features position Yei Finance as a prominent protocol in the omnichain lending space.

“This funding allows us to realize our vision of creating a truly omnichain money market that eliminates inefficiencies and drives DeFi adoption,” said Austin, Co-Founder of Yei Finance. “With V2, we’re unlocking the full potential of decentralized finance through seamless interoperability and user-centric design.”

Looking Ahead

With the $2M raised in this seed round, Yei Finance presents:

- A Fresh, User-Friendly Design: They’re revamping the platform’s interface to make it more intuitive and easier to navigate. Tracking users’ portfolio and engaging with their features will be simpler and more seamless than ever.

- Flexible Modular Lending: Their modular lending markets will allow users to access isolated lending pools tailored to specific assets and strategies. This gives greater flexibility, security, and customized options for all.

- Omnichain Money Market: They’re building a unified liquidity pool to enable smooth borrowing and lending across multiple blockchains. This will eliminate inefficiencies, reduce fragmentation, and improve capital utilization.

This marks the beginning for Yei Finance as it continues to expand and develop. More updates are on the horizon. $YEI.

About Yei Finance

Yei Finance is a major DeFi protocol on the Sei network, boasting the largest money market in the ecosystem with a TVL of $130 million since launching in June 2024.

With its Cross-Chain Bridge, powered by Stargate and Circle’s CCTP, Yei Finance enables seamless and secure asset transfers across major blockchains like Ethereum, Avalanche, and Arbitrum. This innovation reduces transaction costs, improves capital efficiency, and eliminates liquidity fragmentation, setting a new standard for interoperability.

As Yei Finance builds toward V2, it continues to reshape decentralized lending with scalable, omnichain solutions.

They’re just getting started on their mission to transform decentralized lending and create seamless financial solutions across blockchains. Users can stay connected and be part of their journey:

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Source link

Chainwire

https://cryptopotato.com/yei-finance-secures-2m-seed-funding-to-advance-omnichain-modular-lending/

2024-12-16 15:43:22